Leveraging Analytics and ML to Prevent Insurance Gaming and Misconduct

Add bookmark

The insurance industry is changing. Factors such as the COVID-19 and the resulting global recession are ushering in a new era of insurance crime and fraud. In fact, passed recessions have increased fraud rates up to 30%.

Some of this crime will be perpetuated internally by sales agents who, under increased pressured to make their quotas, who may cross the line into criminiality.

For example, in recent months, APAC-based insurance companies have seen increases in:

- Mis-selling. The mis-representation of financial products during sale. The agent provides inapropriate advice and recomendations.

- Conduct of business. Suspected breaches or circumvention of business conduct rules when carrying out financial servies activties

- Fitness & propriety. Cases involving dishonest, incompetent and unfit individuals

So that begs the question, how do we protect our business? This is where machine learning and advanced analytics come in.

This past May, David Hartley, SAS's Global Director, Fraud and Financial Crime Practice, joined us to share how insurers can use machine learning techniques and advanced analytics to more effectively identify and protect against misconduct.

One example he shared was a case study on a top 10 US P&C Insurer who wanted to protect against agent gaming and bad market conduct. More specifically, they were looking to:

- detect agencies that are misrepresenting or submitting fraudulent info to improve close rates, avoid premium and increase commission

- improve handle times to analyse, investigate and take action on agent gaming issues

- develop more proactive and automated monitoring of ongoing agent behavior tracking

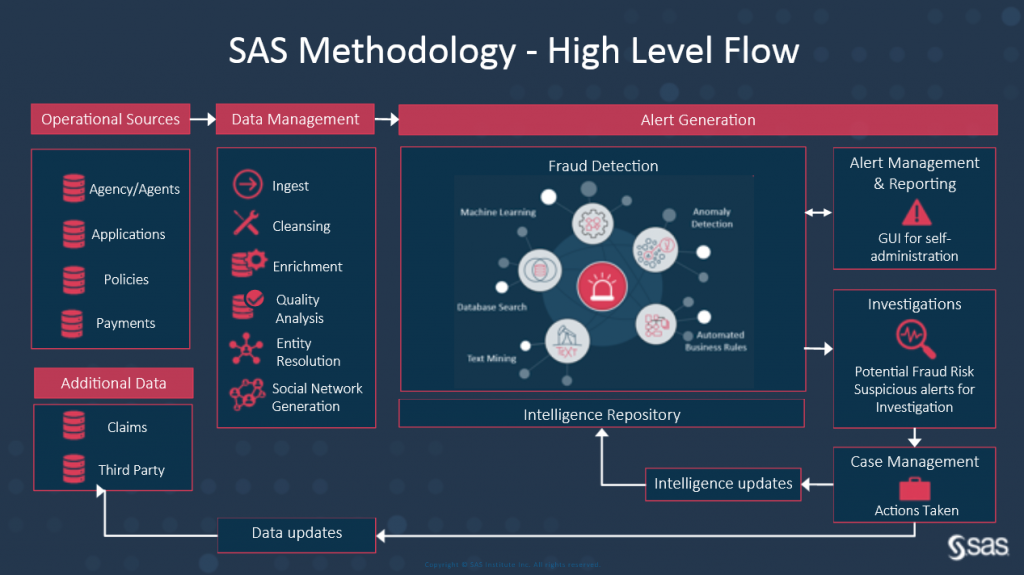

Working closely alongside of fraud prevention, ML and analytics experts at SAS, they developed a new approach based on:

- three year historical data feed of quote, claim and policy data accross 3,500 agencies

- business rules and anomaly detection scenarioes along with predictive modeling using prior internal audit cases

- Network analysis to identify relationships accross agencies and households

- Reporting dashboard for automated ongoing agent monitoring

As a result of this new system they were able to build a system of alerts that notified the business when supicious agent behaviour was detected. As a result, the were able to reduce handling time down to 14 hours and increase efficiency by 547%.

To learn more about this case study and watch a live demo of SAS's Fraud and Finacial Crime solution, watch our FREE on-demand webinar here.